Staff Reporter:

In a bid to mitigate the severe liquidity crisis and prevent bankruptcies stemming from non-performing loans (NPLs), the central bank has introduced a new provisioning model in compliance with international financial standards.

The move aims to ensure banks are better equipped to handle loan defaults and maintain financial stability.

The initiative comes as several banks, including those associated with prominent business groups, have struggled with significant NPLs, causing acute liquidity issues.

In September last, the provisioning shortfall for 10 major banks exceeded Tk50,000 crore, with two state-owned banks, Janata Bank and National Bank, accounting for 65% of this deficit.

To address this crisis, the Bangladesh Bank has opted to implement the International Financial Reporting Standard (IFRS-9) Expected Credit Loss (ECL) model, which will gradually replace the previous provisioning system.

This model, initially adopted in 2014, ensures that provisions are made early, based on a loan’s credit history, performance and future outlook, rather than waiting for the loan to default.

The goal is to prevent sudden liquidity shocks in the banking sector when loans become non-performing.

According to the Bangladesh Bank’s roadmap, the new system will be fully implemented by December 2027.

Within this timeline, banks are required to establish dedicated working teams, including risk officers and financial officers, to transition to the new model.

These teams will report their progress to the central bank in stages, starting with an update in April 2025. By July 2026, the full framework will be in place, with final reports submitted to the Bangladesh Bank.

The transition process will be carried out in phases, with 25% of loan portfolios automated under the ECL model starting in September 2026.

The full implementation, covering 75% of loan portfolios, is expected by June 2027, with the entire banking sector’s provisioning system fully aligned with IFRS-9 standards by December 2027.

Experts believe the new system will improve transparency in the banking sector, preventing the concealment of poor loan portfolios and ensuring that banks’ financial health is accurately reflected.

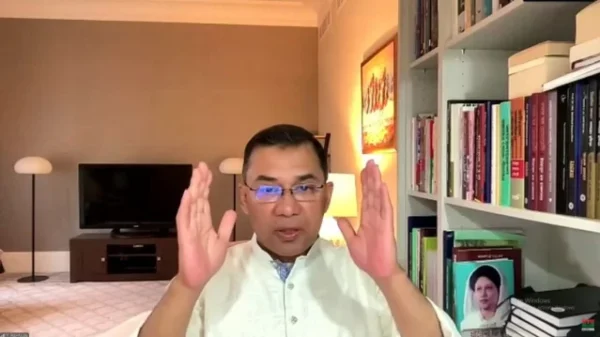

Mohammad Abdul Mannan, Chairman of First Security Islami Bank, said that a similar model was introduced in the 1990s, revealing the true financial state of many banks that had previously hidden their weak positions.

He, however, stressed that while the ECL model would improve provisioning, it would not eliminate the root cause of high NPLs, which often stem from governance issues.

A senior official at the Bangladesh Bank highlighted that the ECL model would allow for automated reporting, eliminating the possibility of data manipulation.

This shift will provide the central bank with real-time insights into the financial condition of each bank, enabling timely interventions when necessary.

The official also noted that banks would need to strengthen their IT infrastructure to meet the demands of this transition, and that the central bank would monitor the capabilities of each bank’s implementation team closely.

As Bangladesh continues to navigate the challenges posed by non-performing loans, the adoption of the IFRS-9 model marks a significant step towards restoring stability and transparency in the country’s banking sector.

Experts said that robust corporate governance and enhanced oversight will be crucial for the system to be effective in the long term.