Staff Reporter:

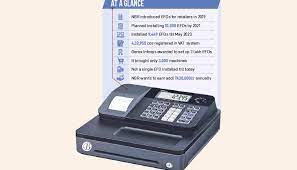

Under a scheme to bring transparency and modern approach in collecting VAT from businesses the Na-tional Board of Revenue (NBR) started installing 3 lakh Electronic Fiscal Devices (EFDs) three years ago, but the revenue agency could set up only 18,005 devices in two years, NBR chairman said.

Once completed, the NBR believes that an additional Tk20,000 crore would be possible to be collected. Because of such a sluggish progress in installing the devices, the NBR has assigned private company Genex Infosys Limited to speed up the process.

NBR Chairman Abu Hena Md. Rahmatul Muneem revealed the information in a press conference on the occasion of marking the VAT Day at the NBR Building in Agargaon on Wednesday.

The NBR launched the project on August 25, 2020, but the progress was not satisfactory after two years of launching the scheme.

The chairman said that the NBR and the Genex have installed the device in 18,505 business establish-ments, including 500 SDCs (sales data controllers).

Now the target is to set up 30,000 EFDs and SDCs by December this year and 60,000 EFDs and SDCs every year. Three lakh devices would now be installed over the next 5 years.

With the machines, taxpayers would be able to automatically submit tax returns and pay tax online.

Muneem said that the VAT payers should continue participating in the monthly lottery using EFD ma-chines-produced challans while purchasing goods or services.

The lottery draw of the EFD challan is held automatically in the first week of every month. The lottery has 101 prizes ranging from Tk 1 lakh to Tk 10,000. The issue will be widely publicised on the VAT Day and the VAT Weeks, he said.

He said that the purpose of observing the VAT Day and the Week is to increase public engagement and awareness in VAT collection.