Staff Reporter:

In 2023, Bangladesh grappled with persistent volatility in its foreign exchange market, despite concerted efforts by Bangladesh Bank to stabilize the situation through significant dollar sales from its reserves.

Economists have pinpointed policy missteps as the root cause, warning that without a shift in Bangladesh Bank’s strategy, the foreign exchange crisis could extend into 2024.

To counter market instability, Bangladesh Bank dispensed a substantial USD $6.7 billion from its re-serves in the first half of the fiscal year 2023-24. During this period, it also purchased approximately one billion dollars from various commercial banks, as confirmed by the central bank’s concerned de-partment.

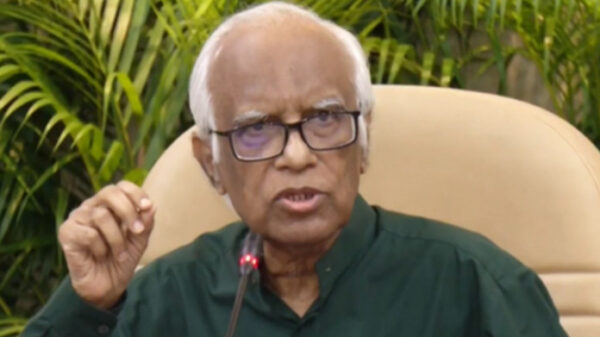

Dr Ahsan H. Mansur, a former senior economist at the IMF, expressed his concerns regarding Bangla-desh Bank’s conservative exchange rate policies. “The increasing demand for foreign exchange is artifi-cial, largely driven by trade-based capital flight. A more competitive exchange rate could significantly curb this trend,” Dr Mansur explained.

He further noted that market-based exchange rates could incentivize expatriates and exporters to increase remittances and repatriate export proceeds.

Prof Mustafizur Rahman, a distinguished fellow at CPD, highlighted another challenge: the deferred payment of foreign liabilities, exacerbating the strain on foreign exchange reserves.

Prof Mustfiz emphasized, “Effective monitoring to prevent capital flight, coupled with competitive ex-change rates, is crucial for minimizing the dollar shortage.”

Md Mezbaul Haque, Bangladesh Bank’s spokesperson and executive director, outlined the dire situation: “Our import costs are not being offset by export income, and remittances are below expectations. This has led to an acute foreign exchange crisis.”

To mitigate this, the central bank sold large volumes of dollars from its reserves, primarily to import fuel, fertilizers, and food. Simultaneously, the bank has been purchasing dollars to bolster reserves, a requirement for securing IMF loans. Yet, the dollar crisis persists, with banks struggling to manage their dollar transactions.

Banks currently buy dollars from expatriates and export earnings at Tk 109.50, while selling to import-ers at Tk 110 officially. However, many banks are charging over Tk 110 per dollar for sales. Some even buy expatriate income at rates as high as Tk 123 per dollar.

As of November 30, 2023, Bangladesh’s foreign exchange reserves stood at $25.02 billion, or $19.40 billion according to the IMF’s BPM6 formula. By December 28, reserves had climbed to $27.04 billion, thanks to IMF loan installments, ADB budget support, and various project disbursements.

Despite these increases, upcoming bill payments in early January, 2024 are expected to diminish these reserves once more, highlighting the continuing challenges facing Bangladesh’s foreign exchange market.