Staff Reporter:

Taxpayers, including companies and firms, with undisclosed money (black money) in Bangladesh have again gained the scope to legalize their undeclared wealth without having to face any question about the sources of their income in next fiscal year.

According to the proposed provision, no authority can raise any question if any taxpayer, including companies, pay a 15 percent tax on cash, bank deposits, financial securities, or any other forms of wealth.

Furthermore, they will have to count a specific tax on properties — land, buildings, flats, or commercial spaces — to whiten their wealth.

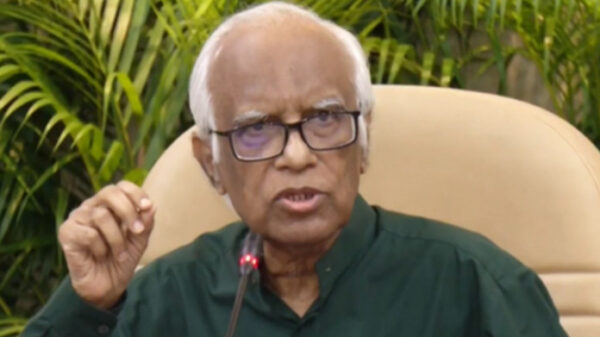

Finance Minister Abul Hassan Mahmood Ali while placing the budget for FY25 at Jatiya Sangsad yes-terday said incidentally the introduction of a data verification system has created legal complications over the disclosure of undisclosed income and assets of various companies.

Moreover, due to unavoidable circumstances, including ignorance of taxpayers in filing returns, there may be “errors” in the disclosure of acquired assets, he said.

“In this situation, I propose to add a clause on tax incentives in the income tax act with a view to provid-ing taxpayers with an opportunity to correct this error in their income tax returns and to increase the flow of money into the mainstream of the economy,” said Ali.