Staff Reporter:

Bangladesh received inward remittances of USD $1.93 billion in November, which is $50 million less than the previous month of October.

According to the provisional data of the Bangladesh Bank (BB) revealed on Sunday, the expatriates sent $1.93 billion in remittance to the country through the legal channel.

In November, state-owned banks received $144.2 million in remittances; two specialized banks received $53.2 million, private commercial banks received $1.72 billion and foreign banks’ branches received $5.92 million.

However, the expatriates sent inward remittances of $1.97 billion in October through banking channels.

According to the data of the Bangladesh Bank (BB), the banking channel received $1.97 million in in-ward remittances in October. Out of this, $154.47 million was received by state-owned banks, $58.2 million through a specialized bank, $58.2 million, private commercial banks received $1.76 billion, and foreign bank branches in the country received $6 million.

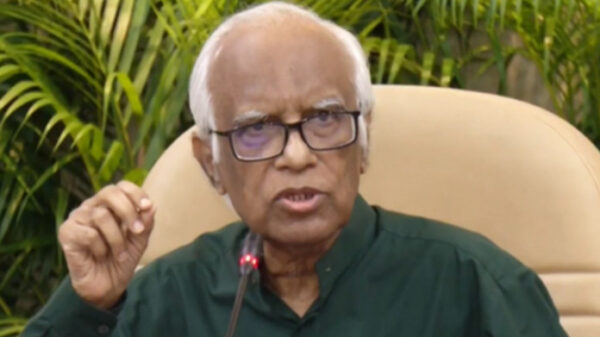

Bangladesh Bank spokesperson Md Mezbaul Haque said that inward remittance flow decreased slightly in November, but an overall trend of remittance arrival is stable so far due to the appropriate initiative of the central bank.

He said the central bank instructed banks to provide additional incentives from their financial sources, which has a role in increasing the flow of inward remittances in the legal channel.

With the government’s 2.5 percent incentive on expatriate income, banks can buy dollars at an additional 2.5 percent higher price. A total of 5 percent of remitters is getting the incentives. As a result, remit-tances are coming to the country through legal channels.

The executive director of the private research institute South Asian Network on Economic Modeling (SANEM) Prof Dr. Selim Raihan said that the long-term benefits of remittance incentives will not work.

He said that the government would give additional two and a half percent over the dollar rate. A total of 5 percent incentive on remittances will boost remittances temporarily. But there will be no long-term solution, he said.

Dr. Selim said,” To increase remittances, hundi should be stopped. If you want to stop hundi, you have to stop money laundering. Now a lot of money is being smuggled abroad and it has to be controlled by any means.”

He said, the more incentives the banks give, hundi traders will give more. So as long as the hundi re-mains rampant, the expected remittances will not come through legal channels.